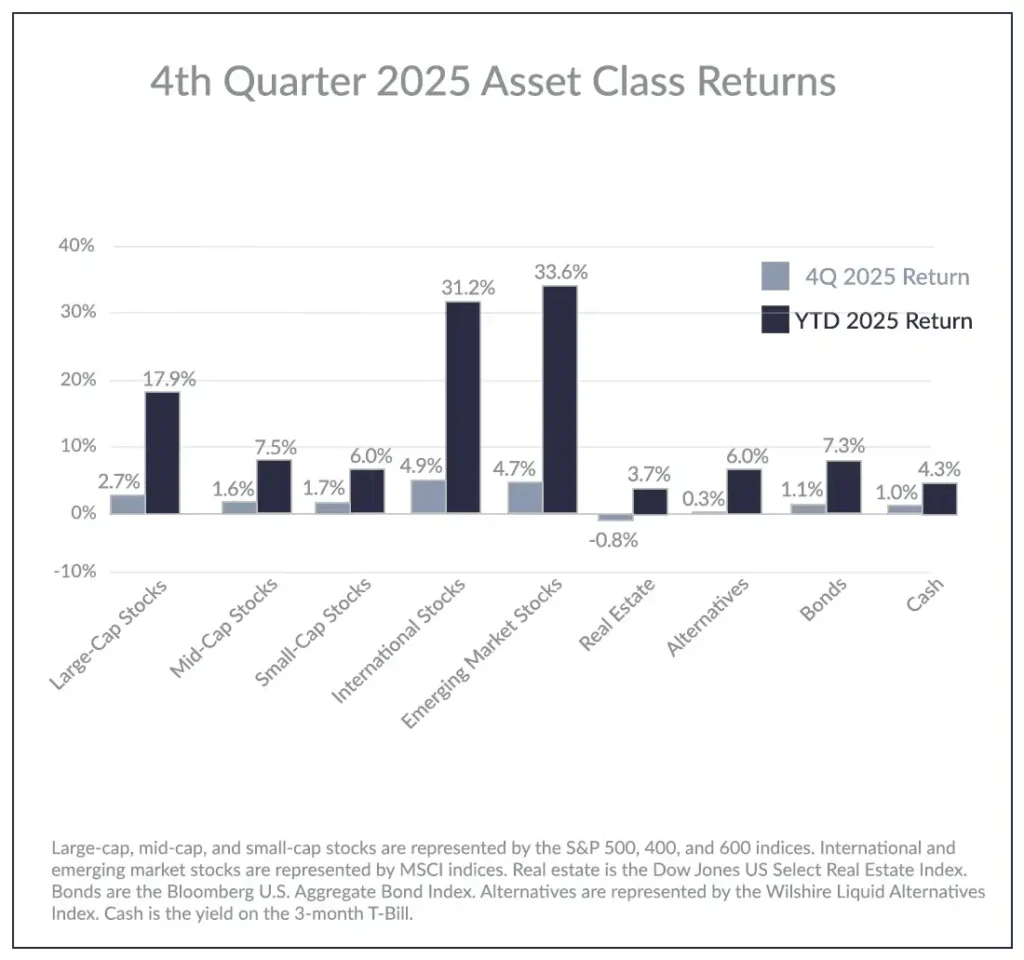

After an impressive run earlier in 2025, stocks continued to edge higher during the fourth quarter. Large-cap stocks led the domestic market for the year, gaining 17.9% and outperforming mid-cap and small-cap stocks, which returned 7.5% and 6.0%. International markets performed even better, with both developed world and emerging market stocks delivering returns over 30%. Liquid alternative investments and bonds also produced solid gains, making it a strong overall year for investors.

AI Drives U.S. Stock Returns

Enthusiasm for artificial intelligence continued to drive domestic returns, with technology stocks leading all sectors and returning 24.7% for the year. This has become a common trend recently, as tech stocks have delivered returns above 20% in seven out of the past nine years. The surge of mega-cap tech stocks has resulted in valuations for both the sector and overall market to levels that were seen near the height of the dot-com era.

Meanwhile, consumer staple stocks, which are defensive in nature, trailed all other sectors, posting a modest 1.6% return. While the recent divergence in returns between growth-oriented sectors compared to more defensive sectors may leave investors itching to chase higher returns, it is important to remember the benefits of remaining diversified over the long term. For example, technology stocks dominated performance throughout the 1990s, only to fall more than 80% between April 2000 and September 2002. Over that same period, consumer staple stocks gained 25%. While there is no way to know if a situation like this will ever happen again, it provides an example of the risks of not having a well-diversified portfolio.

International Markets Lead the Way

International stocks still outperformed U.S. large-cap stocks, despite strong domestic returns. Developed international stocks beat the S&P 500 index by 13.3% — its widest margin since 1993 — while emerging markets outperformed by 15.7%, creating the largest gap since 2009. Strong international returns were supported by a weaker U.S. dollar, increased fiscal stimulus in Europe, AI-driven growth in Asia, and more attractive starting valuations.

Interest Rate Cuts, Narrowing Credit Spreads Boost Bond Returns

The Fed cut the federal funds rate by 0.75% in 2025 during the last four months of the year. Short-term and intermediate-term bond yields dropped, which helped generate a strong 7.3% return for the aggregate bond market. While most Treasury bond yields also declined, concerns over government debt levels and inflation expectations kept long-term interest rates relatively higher.

Corporate bonds performed well this year as bond spreads, which is the extra yield investors earn for holding corporate bonds instead of Treasury bonds, tightened to their narrowest level since 1998. With spreads this tight, investors are being compensated less for taking on credit risk since corporate yields are now not much higher than risk-free Treasury bonds. If spreads widen and return to historical averages, it could weigh on corporate bond returns and performance going forward. While we generally favor safer Treasury bonds in the portfolios we build, we do have some exposure to corporate bonds. What served as a tailwind last year could turn into a headwind for corporate bond returns moving forward.

Strong Year for Alternatives

Liquid alternative investments delivered another strong year of performance. Managed futures, style premia, and reinsurance strategies all generated double-digit returns, while multi-strategy and alternative lending strategies produced more moderate but still positive results for the year. Not only did the asset class perform well, but these strategies saw little volatility earlier in the year when stocks were negatively impacted by economic uncertainty. Over the long term, and especially recently, alternatives have been helpful in providing diversification and additional returns compared with the bond market.

Looking Ahead

As we look ahead, elevated stock market valuations and increasing market concentration raise concerns about future expected returns. Even so, market valuations have been high throughout the 2020s, and the S&P 500 still delivered an annualized return of more than 15% since the decade began. It’s possible that the market will continue to be driven by a narrow group of tech stocks benefiting from the AI theme and driving valuations and concentrations even higher. Or market leadership could change toward more attractively priced pockets of the markets, like small-cap, international, or value stocks. Historically, when valuations have been this high, the latter has been the most common outcome. This reinforces our belief in the importance of maintaining a diversified portfolio.

To learn more about Armbruster Capital and our investment philosophy, or to speak with one of our registered investment advisors, call # (585) 381-4180 or contact us through our website.

Disclaimer:

Armbruster Capital Management’s views as portrayed in this post are subject to change based on market conditions and other factors. These views should not be construed as a recommendation for any specific security or sector. Investing involves risks, and the value of your investment will fluctuate over time; you may gain or lose money as a result. Past performance is no guarantee of future results.