Pity the poor Federal government. It does so much and asks so little. It is therefore incumbent on all of us to give just a little more. But, how do you do it without upsetting the masses? Maybe from a place they’re not really looking at. And how? Maybe sneak in an involuntary payment by reducing an already taxed governmental benefit. How about something that isn’t even a benefit, but rather an income stream the public has already funded? Why not. Let’s also make it reliant on an income number from a couple years ago and have the number be different than what’s on your tax return. And, to add an extra twist, let’s limit it to retirees. Now, we’ve got a plan.

We’re past the holidays, but the echoing of “You’re a Mean One, Mr. Grinch” doesn’t seem too far away. IRMAA, she’s as cuddly as a cactus.

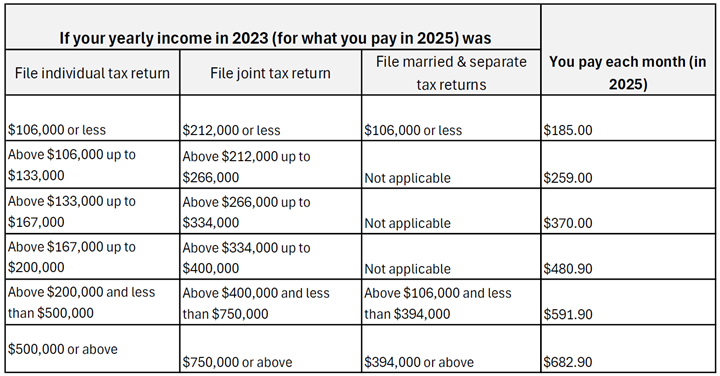

The Income Related Monthly Adjustment Amount (IRMAA) is a surcharge you pay on top of your Medicare Part B & Part D premiums if you have income above the annual threshold. In 2025, if your modified adjusted gross income (MAGI), which is different from your tax return’s “adjusted gross income,” is above $106,000 for those filing as individuals or $212,000 for those married filing jointly, you’ll be paying a higher monthly rate.

For Medicare Part B: Costs | Medicare

Find Out if you will Pay a Higher Part B Premium in 2025

Source: medicare.gov

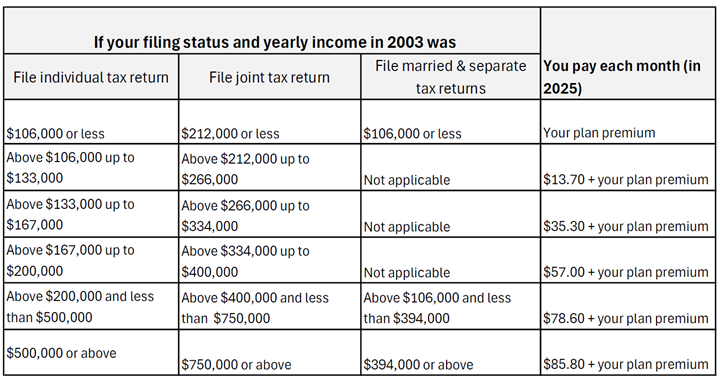

For Medicare Part D: Costs | Medicare

Find Out if You Will Pay a Higher Part D Premium in 2025

Source: medicare.gov

Once you start receiving benefits from Social Security, Medicare Part B and Part D premiums are automatically deducted from your monthly Social Security payment. Any amount associated with IRMAA will also be automatically deducted from your Social Security benefit. If you aren’t collecting Social Security but are enrolled in Medicare Part B and/or Part D, you will receive a bill for your IRMAA assessment.

Your AGI is the total of all your income subject to tax, including IRA distributions (including Roth conversions), capital gains, dividends, interest, and the taxable portion of your Social Security. You can look to line 11 of your federal tax form 1040 for this number. MAGI takes your AGI and then adds in the total of your non-taxable interest, generally from municipal bond income. This amount, from the previous year’s tax returns, generates your Part B & D premiums.

But don’t fret, the government figures out the numbers for you. Typically, when you enroll in Medicare you pay the standard Part B & D premiums until Social Security receives your income data from the IRS. If your income is above the IRMAA threshold, Social Security will mail you a predetermination notice. The notice explains how they calculated the surcharge amount and asks for you to confirm the info and verify you haven’t had a “life-changing event.”

What’s a life-changing event? And why does it matter? Life-changing events include marriage, divorce, the death of a spouse, loss of income, and an employer settlement payment. Retirement is also considered a life-changing event. As a result, you can request a reduction in your IRMAA if you anticipate your income to be lower in the coming year. The Social Security Administration requires you to file a Form SSA-44 directly with them. You can do it online https://www.ssa.gov/forms/ssa-44.pdf or via their phone line at 1-800-772-1213.

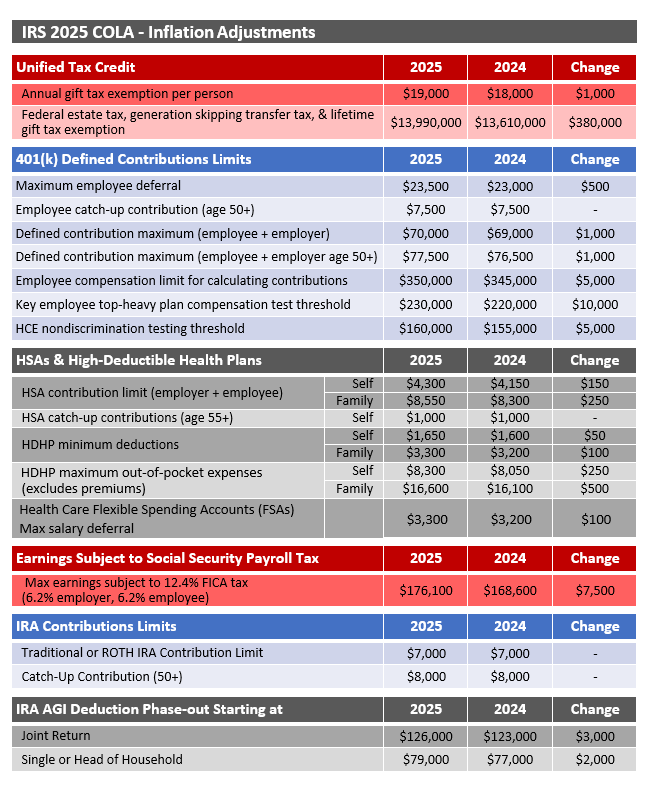

In addition to IRMAA, there are always other changes in the tax law each year that can be difficult to keep current on. Below is a summary of inflation adjustments for 2025:

Contact us for more information and let us help walk you through the details.