The stock market has had a stellar first half of the year. But that’s only true if you were in the right part of the market. The overall US stock market gained 17% so far this year. International stocks were up a solid, but much lower 12%. US small-cap stocks were up only 6%. And deep value stocks rose a paltry 1%. It was the proverbial tale of two markets. The best of times for some, but not so much for others.

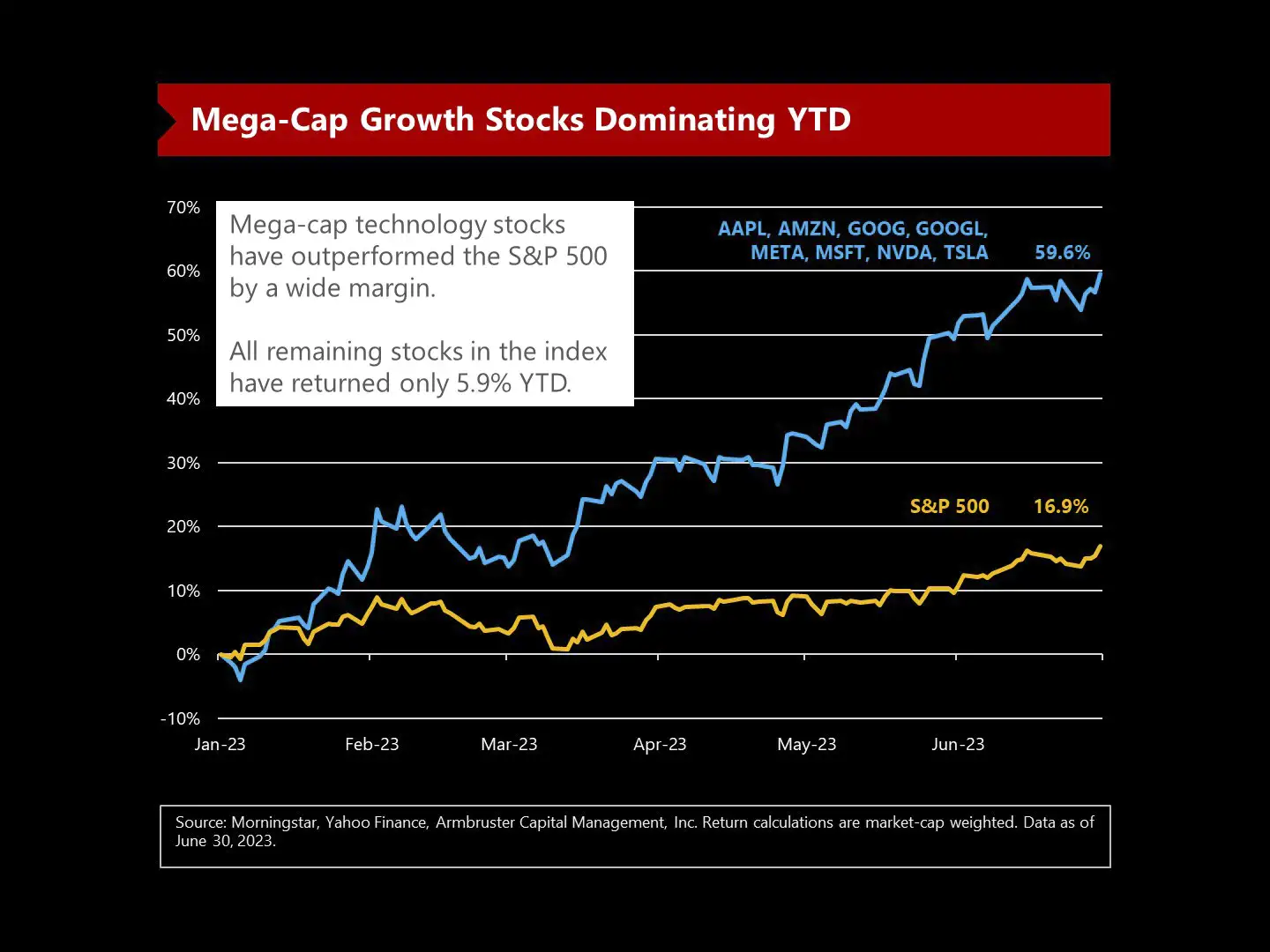

The market has been very narrowly driven lately, with a relative handful of technology stocks contributing most of the growth. For example, while the S&P 500 was up 17% in the first half, seven highfliers (Apple, Amazon, both share classes of Google, Meta, Microsoft, Nvidia, and Tesla) rose 60% while the other 493 stocks in the S&P 500 rose only 6%. Those seven mostly tech stocks are such big companies (Apple’s total market value is over $3 trillion), that their price swings drive most of the index return even in a big index like the S&P 500. So, did “the market” have a great first half, or was it just a statistical aberration?

Magnificent Seven Dominate the S&P 500

Clearly diversification was a liability in the first half, and really over the past several years. That was also true in the Nifty Fifty era of the early 1970s and again during the Dot Com Boom of the 1990s. But that doesn’t mean diversification is dead. In fact, it has often come roaring back just at points when it appeared most useless.

The problem with today’s market is that while tech stocks are dominant, there doesn’t seem to be a good reason for it. Yes, there is the promise of artificial intelligence changing our world and making our economy more productive. However, Iwouldn’t count on that in the short run. The internet made similar promises in the 1990s, which have largely come true, but the trend in economic growth hasn’t changed meaningfully and we still had a dire bear market in the early 2000s as the Dot Com Bubble burst. On the contrary, the fundamentals seem to be deteriorating for many tech stocks. Revenue has been in a multi-year decline and layoffs in the tech sector have been substantial in the past year. So, valuations are rising just as the economic underpinnings of these stocks are deteriorating. That doesn’t make sense.

By the numbers, the price/earnings ratio for the overall stock market is 23. That’s pretty high when compared to historical norms. It is even worse for growth stocks, which are dominated by the tech sector. Their P/E ratio is 34. That makes the stock market expensive and likely overvalued. However, there are a number of bargains in today’s market. Large-cap value stocks have a P/E of 11, small-cap value stocks trade at a 9 P/E, and international value stocks are similarly cheap. These value stocks are generally real companies with real earnings. Their growth may be anemic, or they may be in less sexy industries, but when a downturn comes, as it did in the wake of the Nifty Fifty and Dot Com eras, I’d rather be holding real companies that trade at reasonable levels. Indeed, as the Dot Com Boom turned to bust from March of 2000 through September of 2002, value stocks actually rose by 14% while the S&P 500 fell 38% and the tech-heavy NASDAQ lost an astounding 74%.

When looking at relative performance, the tech sector is at almost exactly the same point versus the overall stock market that it was at during the peak of the Nifty Fifty and Dot Com Boom eras. Those prior periods ended badly for tech stocks. Could this time be differ-ent? Don’t bet on it.

That doesn’t mean we’re due for a huge correction or economic crisis, though I wouldn’t rule that out. However, it very likely means that we’re in a period of very slow growth. We’re expecting that could last for the better part of a decade, and we’re likely in the early stages. The way to address that from an investment perspective is to rely on diversification. Just as value stocks held up in the downturn of the early 2000s, it seems likely that they are again well positioned to weather the storm. Lower volatility stocks should also do well. In fact, the historical data indicate that a diversified factor strategy fares quite well during periods when the overall stock market struggles.

It may be some time until the tide turns, but it seems certain that it will. Our portfolios will leave some money on the table if the mania continues, but we feel confident in how we’re positioned if the economy and stock market falter.

Watch the related ACM InvestED Vidcast: Tech Stock Rally – Can it continue?