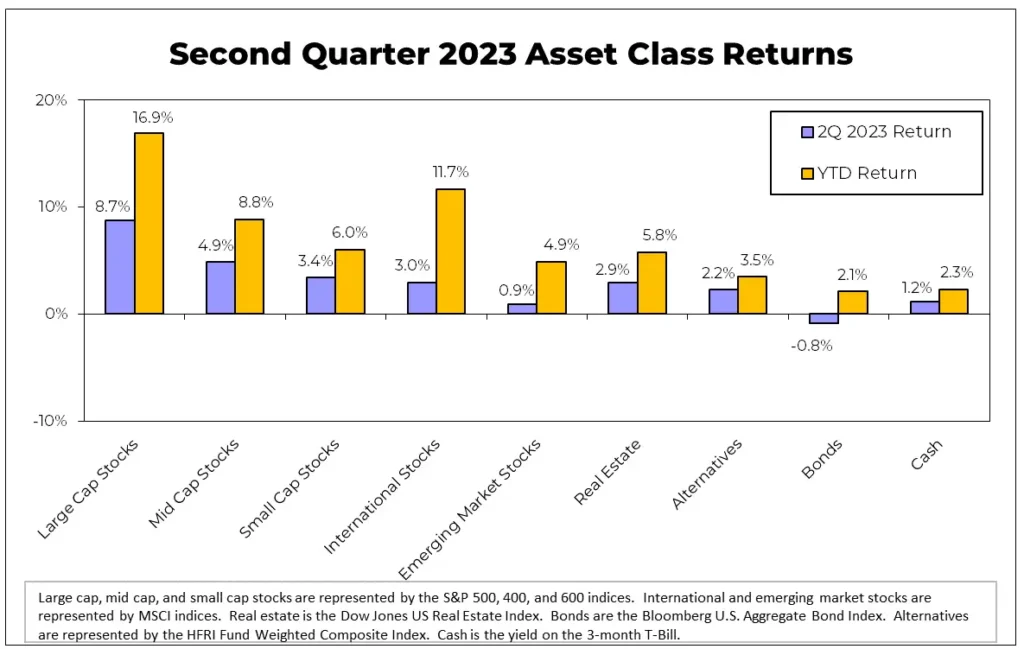

Stock market returns for the second quarter bear a striking resemblance to what occurred in the first quarter: US, international, and emerging market stocks were all positive, large-cap stocks outperformed their small-cap counterparts, developed international markets outpaced emerging markets, and most factor funds lagged behind the overall stock market. Technology, communications, and consumer discretionary sectors continued to lead the way by returning over 10% for the quarter and over 30% for the year-to-date period. The stock market has been quite narrow, meaning just a handful of stocks are driving the lion’s share of returns. This has occurred before, notably in the early 1970s and the late 1990s, during prior technology booms. It may be that hopes for a similar boom, this time driven by artificial intelligence, re driving stocks to what seem to us to be unreasonable valuations.

2nd Quarter 2023 Asset Class Returns

AVOIDING A RECESSION…FOR NOW

It may also be that the economy has held up better than expected. Heading into this quarter, concerns over an imminent recession continued to build, particularly as the reverberations of bank failures were starting to be felt. There was also a potential default on Treasury debt in June if the debt ceiling was not raised. First Republic Bank joined the list of bank failures on May 1st when it was taken over by the FDIC and sold to JPMorgan Chase, making it the second largest bank failure in US history. This contributed to the poor performance of regional banks in aggregate for the second quarter, failing to rebound from their dismal March during the outbreak of the crisis. Because several factor strategies, particularly value strategies, held a high percentage of financial services stocks, performance was well below the overall market. As consumer credit remained strong and no other sizable institution failed following First Republic, widespread fears of these events materializing into a broader economic collapse largely dissipated. However, a new fear soon emerged over the potential of a US debt default. While there have been similar concerns in the past during debt ceiling negotiations, this time it seemed more serious. Indeed, yields briefly rose to over 7% for Treasury securities maturing in early June, the period when the Treasury would likely deplete its reserves to pay bills if a new debt ceiling deal was not passed. The potential crisis was averted with the passing of the Fiscal Responsibility Act (you may find this name to be ironic). The economy continues to hum along, and the crises du jour in the second quarter did not derail that. However, there are still significant longer-term problems in the global economy that bear watching. The largest and most obvious is the huge overhang of debt. The global economy has grown on the back of debt issuance that is at unprecedented levels. Just as an overindebted person can’t continue to spend indefinitely, there are limits to government borrowing. At a minimum, economic growth must slow since it can’t continue in the absence of the debt-fueled orgy of the past few years.

INTEREST RATES ON THE RISE

The bond market lost ground in the second quarter as interest rates continued their march higher. Short-term rates have been driven higher by the Federal Reserve, but now even market-driven longer-term rates are starting to react. Despite moderating some, inflation is still running hotter than the Fed would like. There are signs that it could continue for some time, which likely means we should get used to higher interest rates. The ten-year Treasury bond was yielding 3.28% early in the second quarter and is now over 4% as I write. Rising interest rates mean falling bond prices, thus the negative return for the quarter. More troubling for bonds is that we may be in a new interest rate cycle that will continue for some time. Historically these cycles have lasted between 25 and 40 years. If we do see rates rising on a long-term basis, that could be a real change in the way we live and invest. No more 3% mortgage rates. No more cheap money for corporations to boost their earnings. No more low-rate student loans. No more high valuation levels for stocks. We will need to make decisions differently. This may be corrected, at least temporarily, with a good recession. Generally, interest rates fall during economic downturns. That may be on the horizon, but these are interesting times and anything could happen.