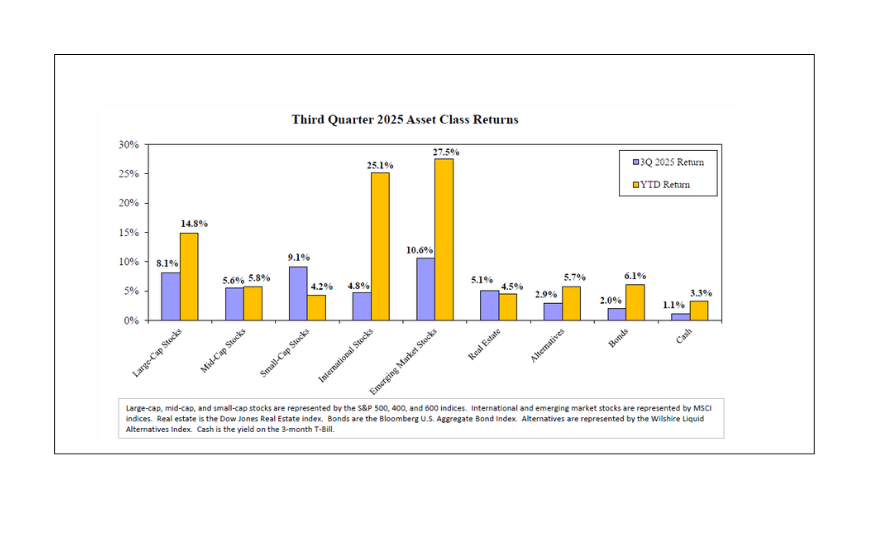

Stocks performed exceptionally well across the board in the third quarter. The S&P 500 climbed to new highs, while small-cap and international stocks also posted healthy returns. Bonds and alternative investments also had solid returns this quarter, adding to their yearly gains.

STRONG RETURNS FOR STOCKS

Stocks rose steadily throughout the quarter, with little turbulence, which was a welcome change of pace from the wild fluctuations during the first half of the year. Within large-cap stocks, tech giants Nvidia, Alphabet, and Apple each delivered double-digit returns for the quarter as they all beat earnings estimates and forecasted strong growth from investments in AI technology. The outperformance of these mega-cap stocks pushed the concentration of the ten largest stocks in the S&P 500 to above 40%, nearly double its long-term average and much higher than the 25% concentration during the peak of the 1990s dot-com bubble.

Despite all the hype around large-cap growth stocks, small-cap stocks actually outperformed this quarter. The Federal Reserve’s interest rate cut boosted returns for small-caps as these stocks are usually more sensitive to changes in borrowing costs than larger companies. Not only did the Fed reduce the current federal funds rate, but it also revised its forecast to include more cuts than previously anticipated. Reduced interest rates, which often boost economic growth, are healthy for stocks, especially small-caps.

International and emerging market stocks have outperformed their domestic brethren and continue to lead year-to-date returns. Both international and emerging market stocks are up more than 25% this year versus the S&P 500’s return of 14.8%. Among these stocks, the best performers have tended to be those that generate little to no revenue from North America, thus avoiding the direct effects of U.S. tariffs. Small-cap and value stocks generally fit this characteristic, which is why these factors have done well in the international space this year.

BONDS AND ALTERNATIVES ADD TO GAINS

Bonds gained moderately this quarter as declining interest rates helped boost bond prices. Credit spreads also continued to tighten after spiking in April due to uncertainty regarding trade policy, which aided returns for corporate bonds.

Alternative investments continue to have another great year as well. Managed futures, style premia, and reinsurance strategies were all positive this quarter, and all have generated year-to-date returns above or near 10%. Over the past several years, the collection of strategies within the alternative investment category has consistently provided returns higher than those of traditional bonds while maintaining a low correlation to stocks.

LOOKING AHEAD

Markets are on track for an above-average year despite a slew of economic uncertainty. Job reports have weakened, inflation has started to tick back up, and trade policy continues to evolve. Indicators monitoring economic uncertainty remain highly elevated, which usually corresponds to high volatility in the stock market. However, markets have remained calm thanks in part to strong economic growth, expectations of increased earnings growth for companies, and potentially lower borrowing costs from interest rate cuts.

In the near term, we cannot predict whether the market will continue to rise at the same rate as it has over the past few years or if risks eventually materialize and negatively impact returns. In either scenario, we maintain the belief that a well-diversified portfolio yields the best results on average and over time. This quarter supports this notion, as diversifying into small-cap stocks and emerging markets helped boost returns, despite how well U.S. large-cap stocks performed. And with the historically expensive valuations of large-cap stocks, it wouldn’t be surprising to see these tech giants bear the brunt of the impact if an economic or stock market downturn were to take place.

To learn more about Armbruster Capital and our investment philosophy, or to speak with one of our registered investment advisors, call # (585) 381-4180 or contact us through our website.

Disclaimer:

Armbruster Capital Management’s views as portrayed in this post are subject to change based on market conditions and other factors. These views should not be construed as a recommendation for any specific security or sector. Investing involves risks, and the value of your investment will fluctuate over time; you may gain or lose money as a result. Past performance is no guarantee of future results.