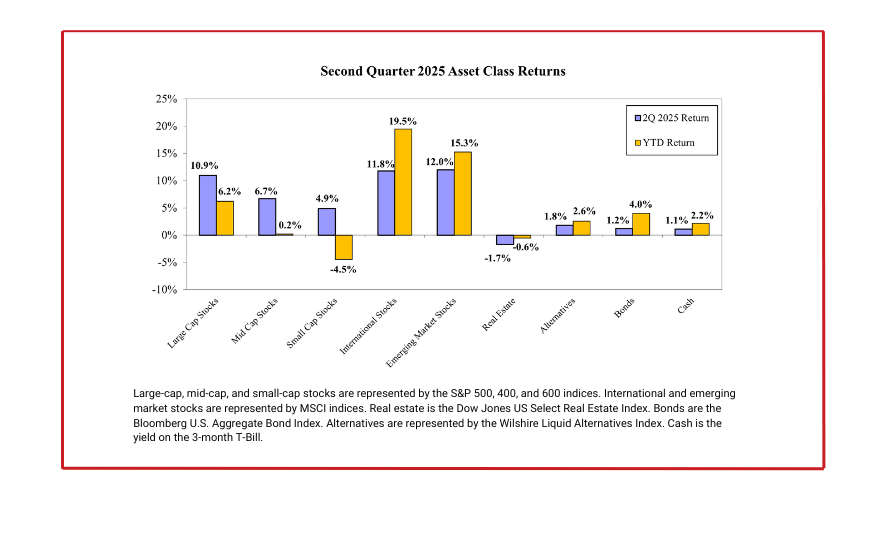

Despite lots of volatility, the capital markets performed well in the second quarter. U.S. large-cap stocks were up an impressive 10.9% but still lagged international and emerging market stocks, which were both up around 12.0%. Bonds are also having a strong year so far, with the aggregate bond market index up 4.0% year-to-date.

Turbulent Quarter for Stocks

While the quarter ended well for investors, it was certainly a wild ride. After a weak showing in the first quarter of the year, stock returns continued to fall into the first week of the second quarter, around continued tariff uncertainty. This caused the S&P 500 to nearly enter bear market territory (a 20% decline in price). However, a 90-day pause on proposed tariffs caused the markets to reverse course, and on April 9th, the S&P 500 jumped 9.5%, one of the largest single-day increases in history. This rebound continued throughout the remainder of the quarter, with the index reaching a record high on the last day of the quarter, closing above 6,200 for the first time ever.

Much of the strong performance was attributable to tech stocks, which rebounded after underperforming in the first quarter. Because the majority of outsized returns were made up by a small cohort of mega-cap stocks, most diversified factor strategies failed to keep pace with the index this quarter. Only the momentum factor strategy was able to outperform the index this quarter, with large-cap momentum returning over 19%. This is a stark difference from the first quarter, when value, low-volatility, quality, and momentum stocks all outperformed the broader market.

International stocks outperformed domestic stocks for the second quarter in a row. The 10% plus decline of the U.S. dollar played a major role in spurring the outperformance of international stocks since foreign currencies appreciating relative to the dollar boosts returns for U.S. investors. In addition to the strong, broad market performance, factor strategies in the international space have generated excess returns in aggregate relative to the benchmark.

Bonds Continue to Rise

Bonds posted solid returns this quarter by adding 1.2%, pushing year-to-date returns to 4.0% for the overall bond market. The higher-than-average returns were helped by a decline in intermediate-term yields, as bond yields and prices are inversely related. Softening inflation reports and a slight decline in GDP for Q1 likely played a factor in the declining interest rates, as these conditions make it more likely the Fed will cut the federal funds rate in the near future. Conversely, longer-term Treasury rates rose last quarter as investors weighed the longer-term risks that elevated government debt and deficit spending could have. This has led to a steepening yield curve, which is a sign that longer-term economic growth will resume. We have been in a flat or inverted yield curve environment for some time now, which has caused many economists to forecast a recession, which hasn’t materialized.

Stable First Half for Alternatives

Liquid alternative investment returns were mixed for the quarter. Reinsurance, alternative lending, and multi-strategy funds were positive, while managed futures and style premia retreated slightly. Year-to-date, all strategies have been positive, with style premia leading with a 9% gain. All other liquid alternatives have generated low single-digit returns so far this year. While returns this year for alts aren’t as glamorous as the high single digit or even double digit returns that some of these strategies have posted over the past three to five years, they are perhaps more characteristic of what an alternatives portfolio has to offer over the long term: a source of returns uncorrelated to both stocks and bonds that can increase portfolio diversification, mitigate volatility, and potentially increase risk-adjusted returns.

Staying the Course

If there is a lesson to be learned this quarter for investors, it is the importance of staying invested over the long-term and having a diversified portfolio. The quarter began with U.S. stocks approaching bear market territory and ended with them reaching all-time highs. As we head into the third quarter, uncertainty regarding international trade, tax policy, and geopolitical tensions will likely continue to move markets. While it is impossible to say which direction markets will move, there is a case to be made for future optimism. Regardless, having a well-diversified portfolio is a more optimal approach for lowering portfolio risk while maintaining your exposures to produce solid returns over the long run.

For more information about Armbruster Capital and our investment management philosophy, contact us through our website, email info@armbrustercapital.com, or call (585) 381-4180.