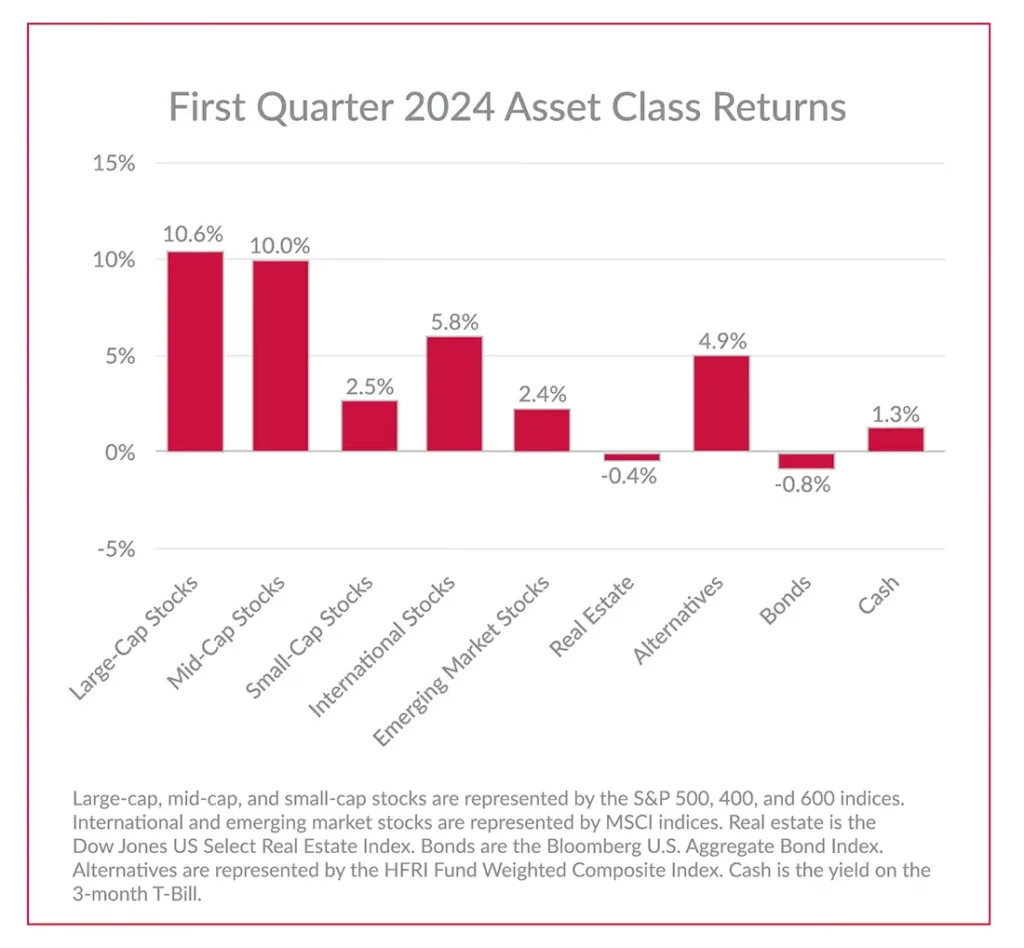

Stocks picked up right where they left off last year by delivering another quarter of strong returns. US large- cap stocks once again led all asset classes as the S&P 500 gained 10.6%, continuing their trend of outperforming small-cap stocks and international stocks, both of which experienced more modest gains. Bonds pulled back slightly after their 6.8% gain in the fourth quarter of last year as longer-term interest rates rose moderately from the start of the year, contributing to a -0.8% loss this quarter.

FACTOR RETURNS

Returns for the various factor strategies were mixed in the first quarter. Momentum was the strongest factor, outperforming each of the other factors by a wide margin. That means that stocks that had outperformed throughout 2023 had generally outperformed again in the first quarter, driving the most expensive stocks to even higher levels and creating even more concentration in the S&P 500. For the large-cap momentum fund, this entailed having high exposure to the five “magnificent 7” stocks that gained this quarter, most notably Nvidia, which extended its AI-fueled rally by another 82%. The two “magnificent 7” stocks that large- cap momentum was not exposed to, Tesla and Apple, dropped by -29% and -11% to start the year, so the strategy was positioned remarkably well. Among large-cap stocks, the quality factor also outperformed, while the value and low volatility factors underperformed but still managed to post returns in the mid-to-high single digit range. While we still like all of these factors over the long term, we especially view value and low volatility favorably given their low valuation ratios and tendency to avoid many of the mega-cap stocks during a time when the market is historically concentrated and overvalued.

1st Quarter 2024 Asset Class Returns

RATES EDGE HIGHER, PRESSURE BOND PRICES

The fall in long term interest rates that helped spur a bond rally in the fourth quarter of 2023 reversed this quarter and put pressure on bond prices. The 10-year Treasury yield increased from 3.9% to start the year to 4.2% at quarter-end and has continued to rise after quarter-end. Yields on the shorter end of the curve did not move much throughout the quarter, staying within the federal funds target range of 5.25%-5.50% for Treasuries with a maturity ranging from one month to six months. This has provided a nice opportunity to earn fairly high returns on cash holdings for the first time in many years.

The consensus now is that the Fed will not cut interest rates as aggressively as previously believed a couple months ago, and that the first rate cut likely won’t occur until the latter half of 2024. The Fed confirmed this change in their view in their latest economic projections. A majority of Fed officials previously believed that three or more rate cuts would occur by the end of the year, but now most are projecting that only three cuts or even less will be needed. The expected federal funds rate by the end of 2025 also shifted from a range of 3.25%-3.50% to 3.75%-4.00% since last December. It makes sense that many believe interest rates will need to stay at their current targets for longer given recent economic data. Headline inflation, as measured by CPI has been stuck above 3% after reaching that mark in June of last year. Core CPI, which excludes volatile food and energy prices, is an even higher 3.8%, far above the Fed’s 2% target rate. Meanwhile, economic conditions still appear strong given the low unemployment rate of 3.9% and latest GDP growth rates of 4.9% and 3.4% over the last two quarters. The Fed will have to carefully navigate when and how many rate cuts are necessary, as cutting too quickly or by too much may result in a second wave of inflation and even higher rates needed to get prices under control, which would be a further bane for bonds.

ALTERNATIVE INVESTMENTS EXTEND GAINS

Many of our alternative investment strategies had another exceptional quarter of performance. Leading the way was style premia, which gained nearly 20%. Managed futures also performed well with an 11.5% return.

Multi-strategy and reinsurance both gained in the mid-single digits, while alternative lending rose by less than 1%. Since the beginning of the decade, this portfolio consisting of liquid alternative strategies has returned over 10% on an annualized basis, which only slightly trails core stocks at less than a third of the volatility. A portfolio of these alternative funds has also greatly outperformed the Bloomberg Aggregate Bond Index’s punitive -0.9% annualized return, again with less volatility. While correlations between stocks and bonds have spiked to over 50% throughout 2020, alternatives have maintained a negative correlation to stocks, making them a better diversifier. Even compared to a shorter-term bond fund which has had lower volatility and better (but still low) returns relative to the aggregate bond index, alternatives still have an advantage on being less correlated to stocks and generating better returns throughout the period. Given current market conditions, expectations for these strategies still appear favorable. Catastrophe bond premiums remain near record high levels. Loan purchases in the alternative lending space are becoming more attractive in terms of quality and return potential as lending standards tighten. Higher short-term interest rates also benefit many of these strategies by providing a higher collateral return.

We cannot predict what the returns will be for alternatives going forward. However, given these favorable conditions, further gains cannot be ruled out. We do know that the long- term characteristics of the alternative funds we have selected are favorable, especially when used to diversify a more traditional stock and bond portfolio.

The first quarter was generally solid for investors, particularly those taking a riskier approach. While the economic backdrop is still strong, we remain concerned about higher stock market valuations and the potential for increased volatility as the year progresses. Wars around the world and our coming presidential election all pose risks for the next few quarters.