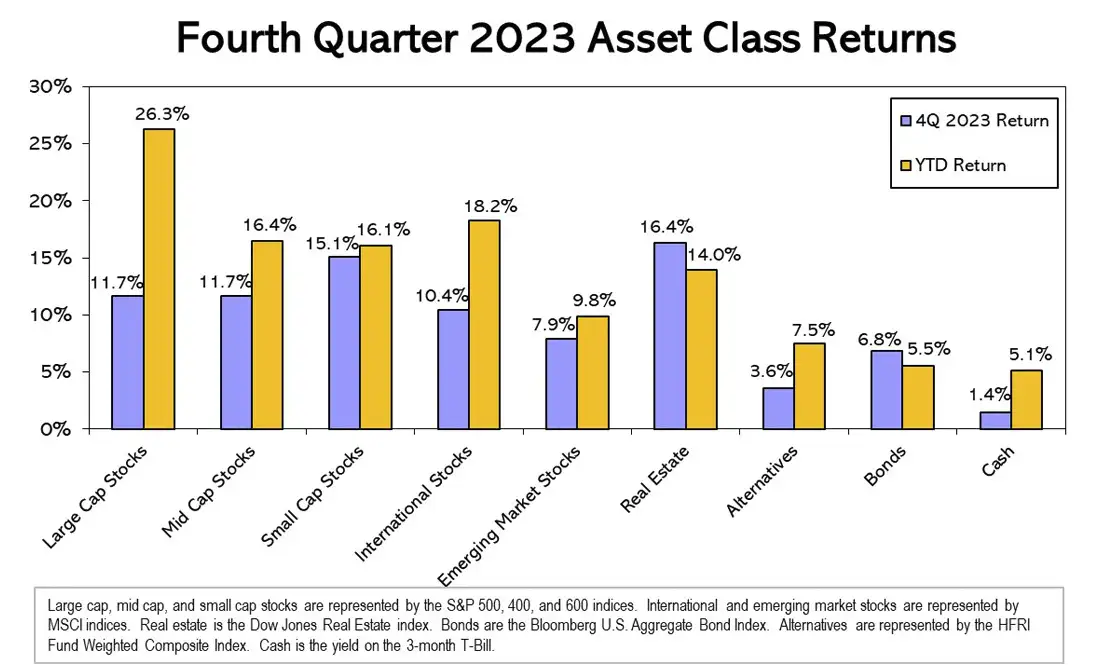

Coming into 2023, there wasn’t much to be excited about. The prior year saw dismal returns for both stocks and bonds, stock valuations were still high compared to their long-term averages, the Fed was still hiking interest rates, and multiple recession indicators were flashing red. Things didn’t improve much from there, as several regional banks failed over liquidity concerns and the potential of a default on government debt increased as policymakers debated over the debt ceiling. Even worse, a war broke out in the Middle East, and the war in Ukraine continued to drag on. This is not the ideal backdrop for investors, yet despite these issues, stocks performed exceptionally well throughout the year. US large-cap stocks led the way, as small-cap and international stocks trailed but still posted double-digit returns for both the full year and the fourth quarter.

PERFORMANCE DRIVERS FOR STOCKS

The stock market behaved very differently in the second half of 2023 compared to the first half. Returns were quite narrow to start the year as overly exuberant investors flocked to technology stocks on the increasing potential of artificial intelligence. While a relatively small number of stocks, the so-called Magnificent Seven, boosted returns in the first half of the year, the remaining stock market in aggregate was relatively flat. This changed in the second half of the year as the market began to broaden. Much of the rallytowards the end of the year can be attributed to a decline in long-term interest rates with investors expecting an easing of monetary policy in the near term.

Unlike in the first half of the year, diversification started to matter again in the latter half. Small-cap stocks finally outperformed large-caps in the fourth quarter. Value, quality, and momentum factors in US markets also slightly bested core benchmarks. International and emerging markets stocks continued to lag US markets, but the performance gap was narrower compared to earlier in the year.

4th Quarter 2021 Asset Class Returns

BOND RALLY

Bond investors finally received some relief to end the year after three years of negative returns. The aggregate bond market returned over 6% in the fourth quarter, elevating the annual return for the index to 5.5%. Despite the potential for interest rate cuts in 2024, we still see benefits to holding shorter-duration bonds. The yield curve is still inverted, meaning bondholders are earning a higher yield by taking less interest rate risk. And while inflation is currently slowing, there have been periods in the past (late 1970s) where monetary policy that was too dovish helped contribute to a second round of inflation. Along with a tight labor market and rising national debt, higher long-term interest rates are not out of the question. In a scenario where interest rates either rise or remain stable, shorter-term bondholders will benefit.

ALTERNATIVES CONTINUE TO RALLY

Liquid alternative investments posted a third straight year of exceptional returns. Catastrophe bonds were the MVP this year returning 44.6% for one fund we use. This was the result of both a quiet hurricane season and increased reinsurance rates. Even the more conservative catastrophe bond funds we use rose double-digits. Looking at some of the other strategies in the asset class, AQR’s style premia fund returned 12.8% and the multi-strategy fund gained 6.4%. Managed futures and alternative lending did not do as well in 2023, but these two strategies still have annualized returns of around 10% over the last three years. We’ve discussed some of the drawbacks to alternative investments (high fees, tax inefficiency, and sometimes reduced liquidity), but they have proven strong performers and important sources of diversification the past few years.

If 2023 is any indication, trying to time the market with any consistency is nearly impossible, especially over a short-time period. The market largely shrugged off the increasing geopolitical risks (wars in Ukraine and Middle East, increasing political polarization) and numerous economic risks (global debt overhang, tightening monetary policy, above-average inflation). Many of these risks remain going into 2024, and likely more will emerge, especially in an election year. Valuations for the broad market are high, but there are still pockets of attractive stocks with lower valuations, such as within value strategies, small-caps, and internationally. It is no guarantee that these strategies will outperform US large-cap stocks in the near term, but they certainly appear to be a more attractive part of the market to invest in over an extended time horizon based on their fundamentals.

For bonds, current yields offer investors a long-term expected return higher than what we have seen in over a decade. However, if inflation remains above the Fed’s target or begins to rise again, we may see yields shoot back up, bringing further declines in bond prices. And for alternative investments, while it is difficult to predict the success each strategy will have, higher short-term interest rates benefit many of these strategies with a higher collateral return. While alternative investments are largely uncorrelated with a traditional stock and bond portfolio, the strategies are also uncorrelated with each other, which contributes to an enhanced level of diversification to the overall portfolio.