Many are happy to see 2020 come to an end, but it was actually a pretty good year for investors. Just like every other aspect of life, the capital markets were a bit weird, but headline gains for both stocks and bonds were impressive.

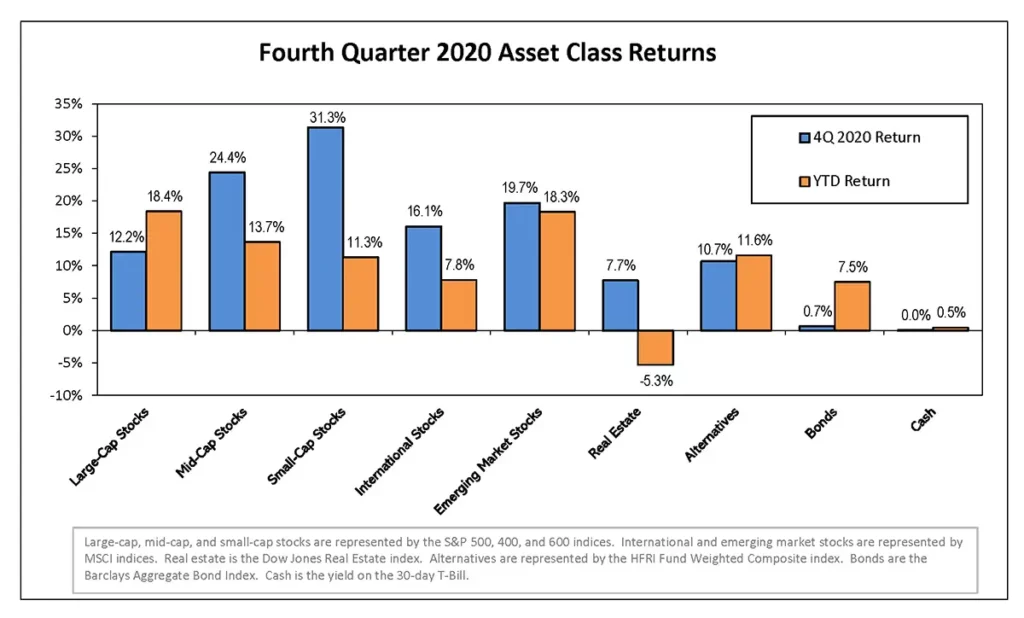

The S&P 500 Index gained 18.4% in 2020. Mid-cap and small-cap stocks earned more modest, but still solid returns of 13.7% and 11.3% respectively. International stocks continued to lag U.S. stocks, but rose a still respectable 7.8%. Very few would have predicted these types of returns back in March when the global economy was virtually shut down for COVID.

A TALE OF TWO MARKETS

The weirdness factor comes into play when you look beneath the returns of the headline indices. Growth stocks rose over 30% in 2020 while deep value stocks posted a loss of around 10%. It clearly was a tale of two markets. Value stocks have historically generated stronger returns than growth stocks over very long periods. However, there are fairly long periods when that has not been true. The current period and the decade of the 1990s are prime examples. Value stocks were already relatively cheap compared with growth stocks at the beginning of 2020, but the COVID shut down hit them much harder than the rest of the market. Value stocks experienced a deep decline that they are still recovering from. They rebounded sharply in the fourth quarter, earning 25.8%. Small-cap value stocks performed even better with a 31.7% return. The fact that they were both still down year-to-date shows the depths of their declines early in the year.

4th Quarter 2020 Asset Class Returns

The value rout was largely because of weakness in banks and energy companies. Banks expected enormous loan defaults because of COVID. They proactively booked large losses as reserves against these defaults, hurting earnings and stock prices. But, so far, the drubbing hasn’t arrived, and it is likely banks will see a boost in their earnings as they reverse these write downs. Energy suffered as oil prices cratered in the face of less demand. Without travel, there is little need for jet fuel or gasoline. However, oil prices have started to recover, and there is optimism that energy companies’ earnings will rebound as the COVID vaccine takes effect and life returns to “normal”.

At the root of value’s woes last year was the fact that the stock market rise was very narrow. It was driven primarily by only a small handful of stocks, the so-called FAANG stocks. That awkward acronym stands for Facebook, Apple, Amazon, Netflix, and Google. Microsoft, Tesla, and a few others were also key drivers of the stock market’s gains, but the rise was certainly not broad based. This is reminiscent of the Tech Boom in the 1990s.

LOWER RETURNS AHEAD

The Tech Boom didn’t end well for investors. While it is not certain that we will see a similar fate this market cycle, valuations for much of the stock market are quite high. Economic stimulus from the government may continue to push stocks higher, but the long-term impact is more concerning. Too much stimulus could lead to inflation and higher interest rates, which would be bad for stocks. A little inflation can help boost earnings, but too much can cause uncertainty, and stock market volatility. Rising interest rates, which often accompany rising inflation, make it harder to justify high valuation levels for stocks, and could be a catalyst for a market decline.

While none of that can be forecasted with any accuracy, there are some things we know for sure. The big one is that high valuations on assets today lead to lower returns tomorrow. So even if stocks don’t decline significantly, their returns are unlikely to be as strong as they have been in the past. When valuations have been at today’s levels, future ten-year returns have generally been in the low single digits.

The same is true for the bond market. The starting yield on bonds is a strong predictor of future ten-year returns. The current yield is just north of 1% but was as low as 0.5% earlier this year. That likely means bond returns will be below inflation in the years to come, despite the bond market’s strong gain of 7.5% in 2020.

A ROTATON AHEAD

A stock market rotation may already be under way. As mentioned above, value stocks staged a strong rally late in 2020. It is not certain if that will continue, but a change in market leadership seems imminent, and those betting heavily on future gains in the largest technology stocks will likely be disappointed. Turning to market segments that have been out of favor, like value and international stocks, will probably be the best bet to generate market-beating returns in the future.

ALTERNATIIVE RECOVERY

Another approach to reaching for better returns would be to use alternative investments. While no one likes these funds after their poor performance the past few years, there were some bright spots in 2020. Both the private lending and reinsurance funds we use posted solid gains in an unlikely environment.

The private lending fund (LENDX) is expected to generate steady gains over time but should lose money when unemployment rises, causing people to default on their loans. Unemployment spiked quickly and sharply in 2020, and the fund declined in value. However, as the year wore on, it became clear that not many people were defaulting. The fund focuses on borrowers with higher credit quality, and many professionals kept their jobs despite rising unemployment. They merely shifted to working from home, while most of the negative impact from unemployment was borne by those in the service sector. So, despite high unemployment, the fund rose 7.6% in 2020.

Similarly, the reinsurance fund (SRRIX) had a decent year, earning 6.8%. This fund should earn money when there are few big storms or natural disasters but should lose money when big storms strike populated areas. 2020 experienced a record number of hurricanes and tropical storms. However, most of them were category three or smaller, and the fund only pays out for damage caused by category four or higher storms. There also were not a lot of storms that made landfall, and those relatively few that did hit areas with lower population density. So, even in an environment where logic would suggest negative returns, the fund was able to perform quite well.

That is not to say alternative investments had a terrific year. There were other funds that lost money. However, LENDX and SRRIX illustrate that markets can work in mysterious ways, and a long-term, diversified portfolio is your best bet for building long-term wealth.

Despite the pandemic, civil unrest, and a highly erratic political environment, 2020 turned out to be a good year for investors. Most forecasts we’ve seen for 2021 call for a strong economy, but the year is still young, and weirdness seems to be the order of the day. We still have a highly divided nation, lofty stock market valuations, and have not definitively cured COVID. So even though we may need to buckle up in the near future and ride through some turbulence, a thoughtful and diversified approach should still keep the long-term destination in view.