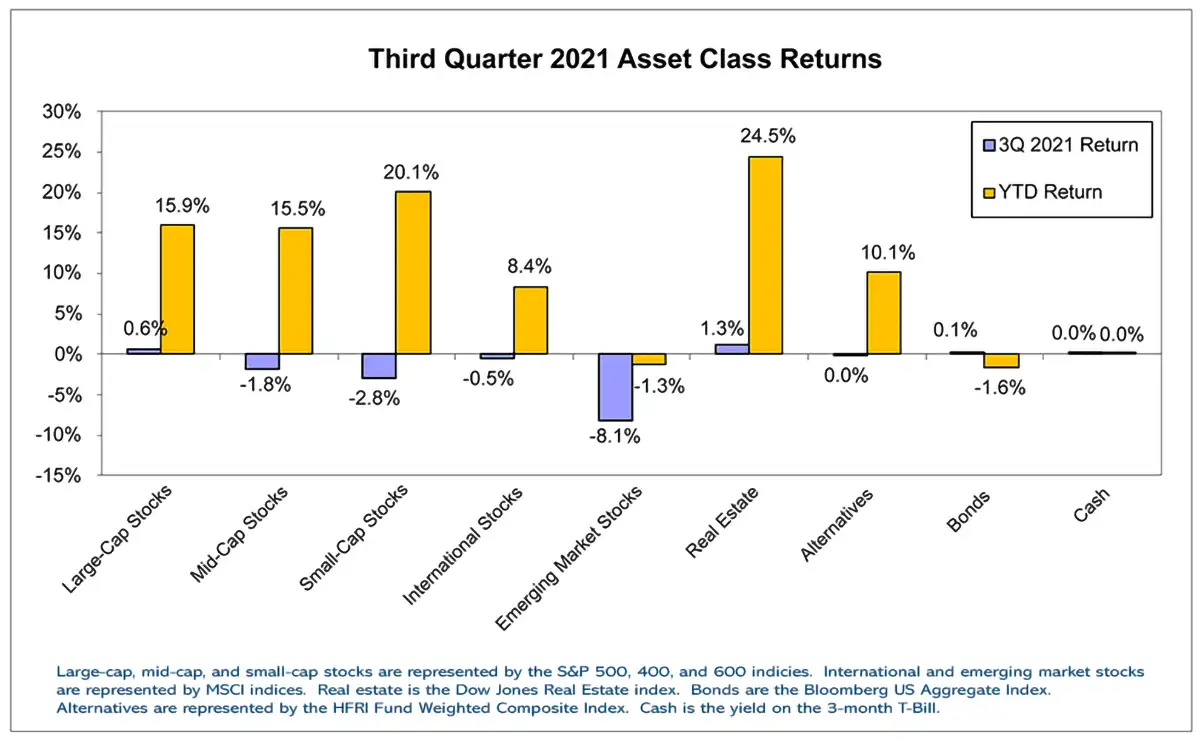

Stock market returns were effectively flat for the third quarter. July and August experienced fairly strong returns, but losses in September weighed on full quarter results. Mid-cap and small-cap stocks were slightly negative this quarter, but strong performance in the first half of the year has still provided attractive year-to-date returns.

While small-cap stocks faltered in the third quarter, their returns have been quite strong over the past eighteen months. Valuation metrics, such as the price/earnings ratio, have been much more attractive for smaller company stocks recently. Despite their strong relative performance of late, small-cap valuations still remain far below those of the overall stock market, which may bode well for their long-term relative performance going forward.

3rd Quarter 2021 Asset Class Returns

Internationally, developed markets fared better than emerging markets, but both have generally continued to lag behind U.S. stock market returns. Much of the poor performance in emerging markets occurred in July as China imposed restrictions on private companies in the education sector. Returns continued to fall in September as Evergrande, one of China’s largest real estate developers, faced increasing possibility of defaulting on its interest payments. Fear of the impact this event could have on the Chinese economy and global financial markets contributed to lower returns throughout international and domestic markets.

Along with weak stock market returns in September came an increase in stock market volatility. There were a number of factors contributing to the higher volatility. Economists reduced U.S. GDP growth estimates for the remainder of the year, citing a surge in the Delta variant as a primary headwind to demand. On the supply-side, shortages in labor and various raw materials, as well as supply chain disruptions, pushed inflation above 5%. The Fed reacted by revising their expectations for future interest rate hikes to a date sooner than previously expected and indicated a taper on asset purchases beginning as early as this year.

Stock returns reacted negatively to rising yields, most notably growth stocks. Growth stocks tend to underperform value stocks during periods of rising interest rates as it makes future profits appear less attractive to investors. Currently, growth stocks also face regulatory headwinds as companies like Facebook, Apple, and Google face lawsuits and Congressional investigations. Given how expensive growth stocks are, and how reasonable value stocks currently trade, it would not be surprising to see the rotation out of growth stocks and into value stocks continue and intensify in the future.

Higher inflation expectations influenced a sell-off in bonds towards the end of September. This wiped out the modest return that the high-grade bond market generated in the beginning of the quarter and caused the U.S. 10 Year Treasury yield to rise from 1.28% to above 1.5% in the final weeks of the quarter. Bond returns have been uninspiring, and likely will remain so for several years since the current yield is a strong predictor of future returns, and today’s yield is a paltry 1.5%.

So far this year, stocks have generated high returns, especially in the domestic market. Bond returns have not fared as well with interest rates starting the year at historically low levels and facing upward pressure with higher inflation. If inflation remains elevated longer than expected, it may continue to negatively impact both bond and stock returns. In addition to inflation concerns, unresolved government deadlines regarding the debt ceiling and government funding threaten to add to market volatility to close out the year. Additional volatility seems imminent.