Portfolio Review Q2 2024: Emerging Markets Outperform, US Stock Concentration Rises

07/15/2024

07/15/2024

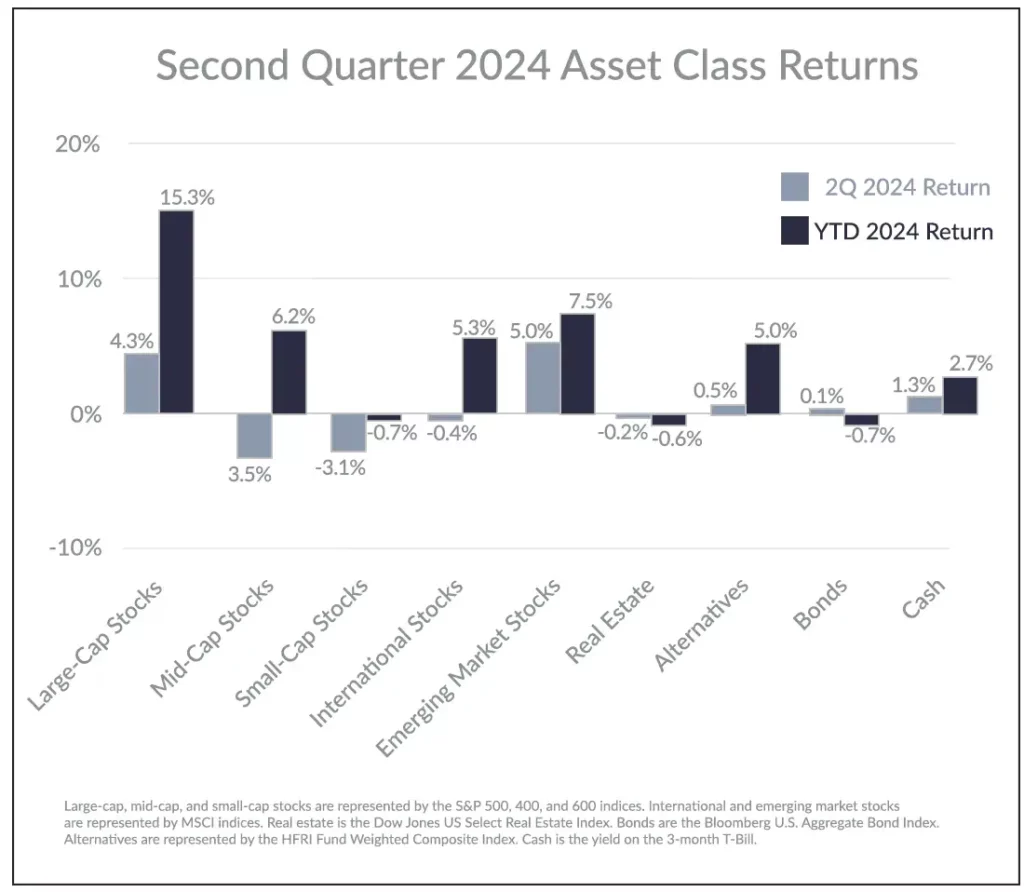

Stock returns were mixed in the second quarter. Surprisingly, emerging market international stocks led all other asset classes with a 5% return for the quarter. However, US large-cap stocks weren’t too far behind as the S&P 500 gained 4.3% and continued the trend of large company stocks dominating returns. Mid-cap, small-cap, and developed market international stocks all pulled back slightly after a positive first quarter. Bond returns were flat as the yield curve has remained fairly stable over the past few months.

EMERGING MARKETS PERFORMANCE LEADS THE WAY

Emerging market stocks were the top performers for the first time since the third quarter of 2020. Returns were driven by strong performance in China, India, and Taiwan, which collectively make up over 60% of the MSCI Emerging Markets index. All three countries generated returns of over 6%. This is a welcoming sign for emerging markets, whose returns have struggled relative to both the US and other developed market stocks for an extended period.

Does that mean the time has finally come for the emerging markets? Maybe. But even if it is a bit too early, there are numerous reasons to allocate at least a small percentage of stocks to emerging market stocks. One reason is that emerging market stocks pose a more significant risk than stocks in developed countries. Higher risk may sound undesirable, but this increases the potential for higher returns. And because emerging market stocks have fairly low correlation with large company stocks in the US, their inclusion can potentially reduce the risk of an overall stock portfolio.

2nd Quarter 2024 Asset Class Returns

Many emerging market countries are also projected to have higher, if more erratic, GDP growth rates than developed nations in the coming years. This projection is supported by higher expected population growth and relatively low national debt to GDP levels, among other factors.

Not only are growth expectations higher for emerging market nations, but valuations for these stocks are also lower, as the core emerging markets index trades at around 15x earnings while the S&P 500 approaches a Price/Earnings ratio of 26x. Strong growth expectations and attractive valuations are a nice and increasingly rare combination in today’s stock market. Emerging market stocks are notoriously volatile, but with a little patience, we see outsized rewards in the coming decade.

US STOCK MARKET CONCENTRATION CONTINUES TO RISE

Mega-cap stocks continued to best all other US stocks this quarter. NVIDIA led returns, whose 150% gain year-to-date has contributed 30% of the S&P 500’s growth this year. As a comparison, the smallest 490 companies in the S&P 500 have contributed less than 29% of the index’s returns. The narrowness in today’s market has resulted in an extreme level of concentration and, therefore, risk. The top ten largest companies now make up over 35% of the index, far exceeding the Dot-Com bubble’s peak concentration of 27% and rivaling the concentration levels during the tech boom of the early 1970s right before the “Nifty Fifty” stocks began to underperform the broader market.

Today’s top ten US stocks by market cap not only make up a large percentage of the index but are also very expensive, with an average Price/Earnings ratio of over 50x, almost double the P/E ratio of the overall S&P 500. This combination of high concentration and valuations is concerning for US markets. Historically, narrowly led technology booms did not end well.

We often hear the justification that today’s top performers are nothing like the top stocks in the late 1990s because today’s stocks are hugely profitable, stable companies versus the start-up internet stocks of the prior cycle. However, that doesn’t mean there isn’t downside risk. Solid companies can still see their stock prices run away from fundamentals, which is exactly what happened in the 1970s. The Nifty Fifty stocks of that era were solid, blue chip, growth companies. That didn’t stop them from dropping 50% when the bear market arrived.

Perhaps the excitement around AI’s potential warrants some stock price premiums for companies able to capitalize on new technologies. However, that was also the promise of the internet era. And while the internet revolutionized the way we work and improved productivity, it didn’t prevent a nasty bear market and economic recession.

While we cannot predict if or when we will see a similar pullback from the current AI mania, the parallels in risks from high valuations and concentration are becoming more apparent. With the growing risks, it becomes even more important to avoid the herd mentality of chasing the highest return stocks and remain disciplined in academic and time-tested investment strategies.

BONDS and ALTERNATIVE INVESTMENTS

Bond returns were positive for the quarter, but just barely. The Bloomberg Aggregate Bond Market Index gained only 0.1% for the quarter, while short-duration bonds fared slightly better. Over the quarter, the 10-year Treasury bond yield increased from 4.2% to 4.35%. Rising interest rates are bad for bond prices, so any creep-up in rates holds bond returns back. The yield curve remains inverted, so shorter-term bonds are generally outpacing long-term bonds. At the extreme, 3-month Treasury bills have had some of the strongest returns lately. It is tempting to sell out of longer-dated bonds and just buy T-bills, but if interest rates decline from here, we would miss out on some return potential. We would also be unable to reinvest the proceeds from maturing T-bills into new bonds with similar yields. So while we remain defensively positioned with our bonds, we have resisted the temptation to effectively move to cash. Longer-term, we expect this will provide the best return potential.

Returns for the various alternative investment strategies saw little change this quarter. Style premia was the best-performing mutual fund with a return of 2%, while managed futures performed the worst with a loss of -1.1%. Despite the lack of returns for the quarter, alternatives are still strong for the year. Both style premia and managed futures have posted double-digit returns year-to-date, while all the liquid strategies we employ have been positive. The liquid alternatives portfolio, in aggregate has a year-to-date return near 10% and has generated annual returns at or around that level since the beginning of 2021, quite a turnaround from its performance in the late 2010s.

Overall, returns for stocks, bonds, and alternative investments were minimal in either direction this quarter.

Economic signals were also mixed:

Investors still have much to worry about, but that was also true last year, and stocks have returned over 20% since then. So, it is best to tune out the economic ups and downs, global conflicts, and upcoming elections, as hard as that can be, and remain focused on your long-term investment strategy.