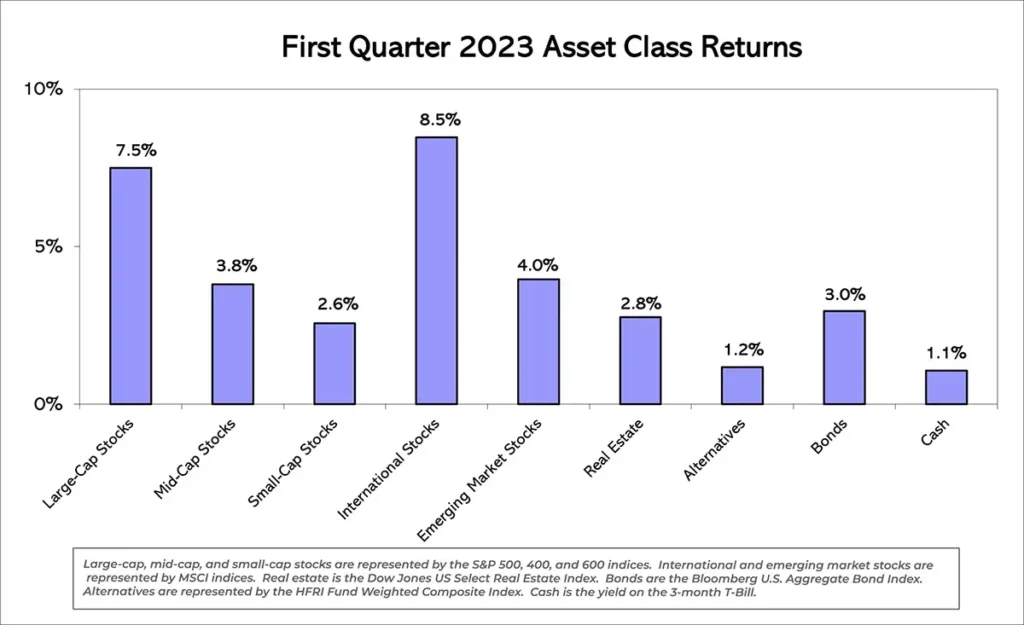

After experiencing a year of weak returns, both the stock and bond markets got off to a strong start in the first quarter of 2023. Core large-cap and developed international stock indices generated returns in the high single digits, and bonds posted their strongest quarter since the first quarter of 2020.

REVERSAL IN SECTOR RETURNS

Technology stocks started the year with a rebound after drastically underperforming the S&P 500 in 2022. The performance was driven primarily by mega-caps such as Apple, Alphabet, Amazon, Meta, and Microsoft, all of which posted double-digit returns. Conversely, energy stocks, after gaining 65% in 2022, were one of the worst performing sectors this quarter as oil prices eased from their prior year highs. Financials also took a hit this quarter and were down 5.6% as the banking crisis unfolded in March.

The sector exposures of various factor funds led to some underperformance this quarter after a relatively strong 2022. Value stocks and low-volatility stocks were negatively impacted by their overweight positions in financial services, the worst performing sector this quarter. Meanwhile, momentum stocks suffered from their overweighting energy and healthcare, the second and third poorest sectors in the first quarter. While factor performance overall was subpar this quarter, valuations for these funds remain attractive, which bodes well for future gains.

1st Quarter 2023 Asset Class Returns

The banking sector experienced an extremely volatile month in March due to the failure of several banks, including Silvergate, Silicon Valley Bank, and Signature Bank, as well as UBS’s purchase of Credit Suisse to prevent its collapse.

Banks hold large portfolios of bonds, and with the rise in interest rates last year, they were estimated to have $620 billion in unrealized losses as of yearend. Making matters worse, as interest rates rose, depositors pulled their cash in search of high yields elsewhere (see Chris’s Corner). This created a demand for cash that banks couldn’t meet without selling portions of their bonds and locking in losses. Bank runs and failures ensued. The FDIC stepped in to make sure depositors didn’t lose money, but confidence in smaller banks has been shaken.

Regional banks still saw hundreds of billions of dollars of outflows in March that made their way into larger, “too big to fail” banks, as well as higher-yielding Treasury bonds and money market funds. This resulted in regional bank stocks falling 24% for the quarter, while the “Big Four” US bank stocks pulled back only 5%.

Longer-term the crisis will likely lead to tighter lending standards, which could limit corporate earnings growth, weigh on economic growth, and ultimately impact stock returns.

Treasury yields saw a similar level of volatility, but in a good way, from the banking crisis in March as investors fled to safer assets. The 10-year Treasury yield fell from over 4% at the beginning of March to just below 3.5% to end the quarter. This helped recoup losses bond investors experienced last year.

However, this further inverted the Treasury yield curve, a historically reliable recession indicator for the United States. The Fed has indicated that it will likely raise interest rates one more time this year before holding steady at a target range of 5.00% to 5.25% until inflation is meaningfully reduced. We’re not holding our breath that they’ll get inflation under control that easily.

Despite the turmoil in the banking sector, the first quarter was solid for investors. There is still much to worry about in the economy and the world as a whole. However, the quarter was a reminder that you can’t predict capital market returns. Even when bad things happen, like bank runs, the markets can still hang tough. It can be tough to hang in there, but a long-term perspective is still the best bet.