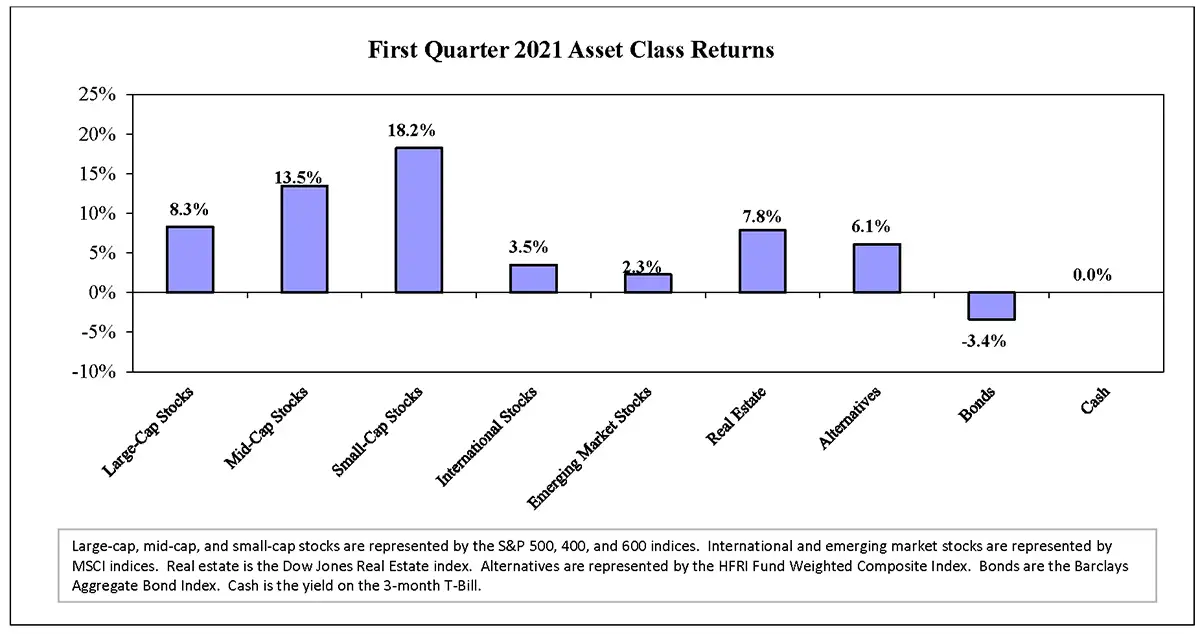

The first quarter of 2021 was a solid one for stock investors, but not so great if you own bonds. However, for both stocks and bonds it was a period of transition, reversing trends that have been in place for many years.

For stocks, the overall market as measured by the S&P 500 rose 8.3% in the first quarter. This is a very solid return for a three-month period. However, other parts of the stock market performed even better. Mid-cap stocks earned 13.5% and small-cap stocks gained 18.2%.

The bigger news was the return over the past year. The S&P 500 was up almost 75% since the trough of the market last March 16th. Small-cap stocks rose 121% over the same period. This was the largest and fastest rebound in the stock market ever.

The rotation from larger stocks to smaller stocks was a big change, as the largest stocks, particularly large technology stocks, have been the primary drivers of the stock market’s growth for the past several years. In fact, diversification has been a liability for the better part of a decade now. Being concentrated only in high-growth, U.S.-based, large-cap stocks has been the best bet. Deviating from that resulted in lower performance. However, while periods such as this are not unprecedented, they do not last forever. The strong growth of large tech stocks has pushed valuations for many to extreme levels and made for relative bargains in other parts of the market. Cheaper small-cap stocks have finally responded, and those stocks are catching up with their large-cap brethren.

The same is true with value stocks. While they have experienced roughly a decade of underwhelming performance, they roared back to life in the first quarter, outpacing growth stocks by over twenty percentage points. There is still ground to make up, but when value rallies occur, they tend to last for multiple-year periods. Despite the recent rebound, value stocks still trade at large discounts to growth stocks, which should allow the value rally to continue for some time, even if it comes in fits and starts.

International stocks are one part of the stock market where relatively cheap stocks have not responded. International stocks continue to lag behind U.S. stocks, despite being priced at far more attractive levels. Perhaps this is because developed international economies such as those in Western Europe and Japan are still languishing. They are plagued by negative interest rates, slow GDP growth, and have not made the same progress as the U.S. with regard to vaccination. We expect to see international stocks, particularly those in the emerging markets, perk up in the not-too-distant future, but it isn’t happening yet.

Alternative investments also had a solid quarter. While not all the funds performed well, a couple were very strong, leading to solid performance for the overall alternative investment portfolio. Times of transition are often good for alternative investments, as volatility and dislocations can uncover profit opportunities that are lacking when stocks trend higher for long periods. Particularly with rising interest rates and a threat of inflation on the horizon, it would not be surprising to see alternative investments outpace bonds and even rival the performance of stocks in the coming decade.

1st Quarter 2021 Asset Class Returns

That leaves just the bond market with poor returns for the first quarter. Rising interest rates drove down bond prices, which resulted in a loss for the overall bond market. Twelve months ago, the ten-year Treasury bond yielded around 0.50%. At the end of the first quarter it was close to 1.7%. This also may be the start of a longer-term transition to rising interest rates.

While rapid changes in interest rates can be painful for bond investors, the current level represents a more normal and sustainable rate. Interest rates may rise even further in the future, particularly if inflation materializes, and we have generally taken a more defensive bond position in response.

That defensive position includes shortening the duration, and there-fore the interest rate sensitivity, of the portfolio, as well as increasing credit quality. Given the low yield environment we’re in, it just doesn’t make sense to take a lot of risk in the bond market.

Even with negative bond returns, the first quarter was solid for investors with diversified portfolios. There are certainly many clouds gathering on the horizon, but continued government stimulus and monetary accommodation could lead to further gains in the near term.